tax sheltered annuity vs 401k

Taxes need not be paid. Contribution limits for a 403b.

403b Vs 401k What S The Difference

An additional distinction is that with an annuity the individual has to make investments with hisher own money while a 401 k is set up by an employer.

. 401k is a retirement product or plan offered by the employer. You will not owe income taxes on the investment returns of a 401 k or annuity until you. Just as with a.

Its similar to a 401k plan maintained by a for-profit entity. An annuity is not tax-deductible. You get all the.

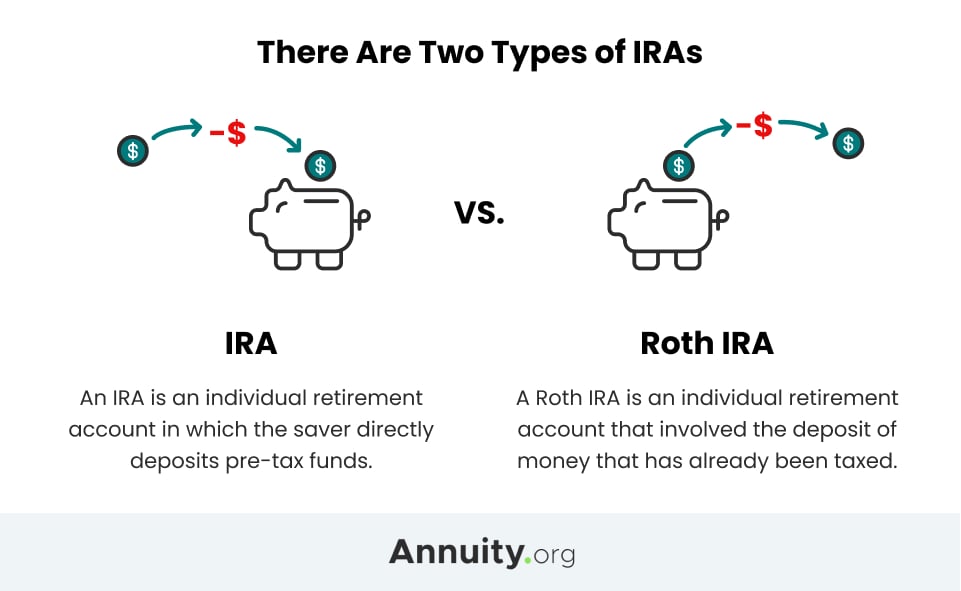

A Roth IRA is a retirement plan. Although 401k plans are the most popular an alternative known as a tax-sheltered annuity or TSA plan is available to many workers especially in the nonprofit world. A variable annuity is an investment product for retirement planning that allows you to participate in investments including stocks bonds and a mutual fund.

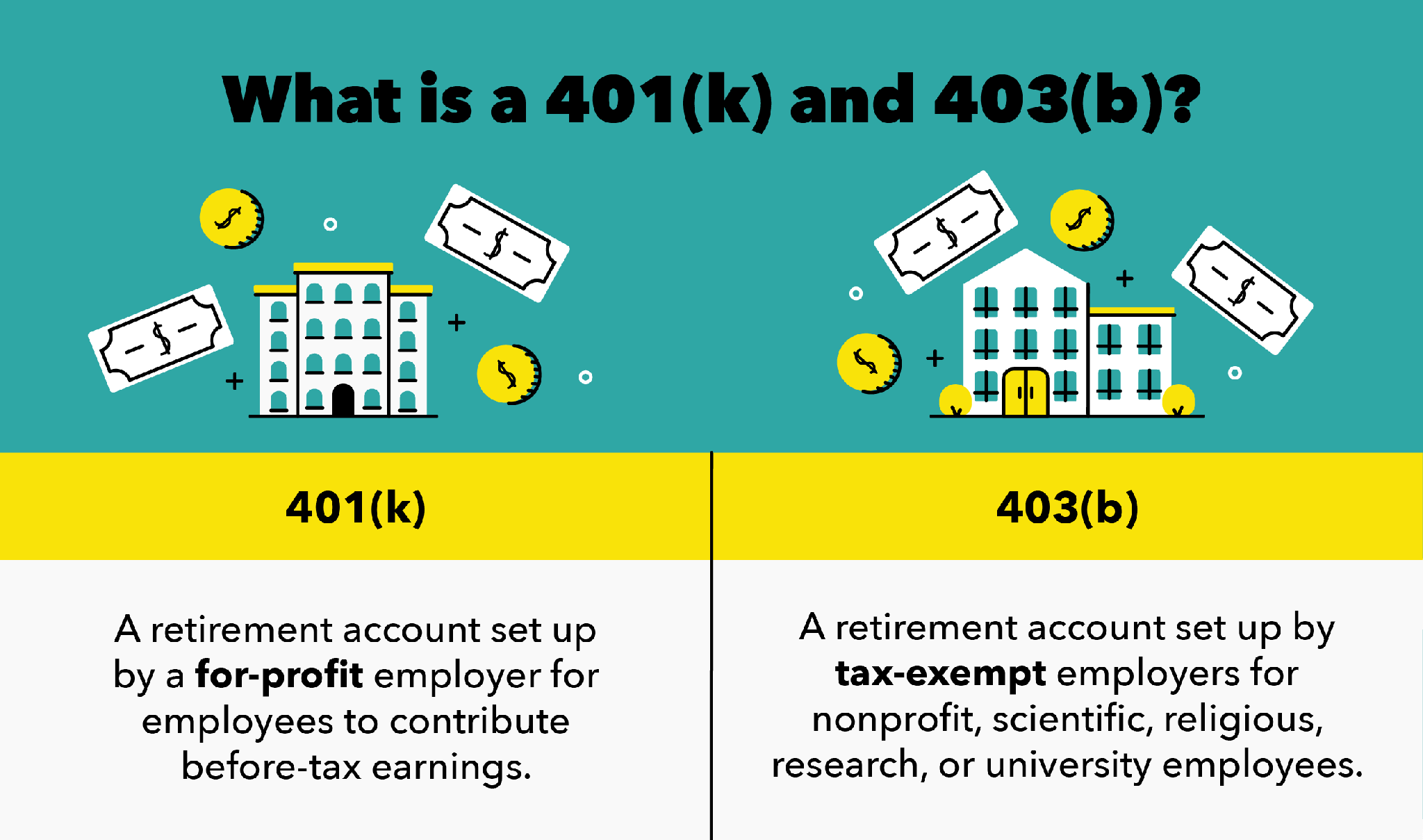

A tax-sheltered annuityalso known as a 403 b plan or a TSA planis a type of retirement plan only offered by certain 501 c 3 tax-exempt organizations such as charities. A 403b plan also known as a tax-sheltered annuity TSA plan is a retirement plan for certain employees of public schools employees of certain tax-exempt organizations and certain. When the 403b was created in 1958 it was known as a tax-sheltered annuity as it only offered annuities.

A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt organizations. An annuity is an investment vehicle with tax-deferred growth. The terms tax-sheltered annuity and 403b are often used interchangeably.

Tax Sheltered Annuity Plans. An annuity is an insurance product. A 403b plan is also known as a tax-sheltered annuity or TSA plan.

For 401k plans the total contribution limit including catch-up contributions is 64500 for 2021 and 67500 for 2022. Both annuities and 401 ks provide a tax-sheltered way to save for retirement. A tax-sheltered annuity TSA is a retirement savings plan that allows employees to invest pre-tax dollars in an account to build retirement income.

It offers a double tax benefit. You only pay taxes on the growth when you remove the funds. A 403b plan tax-sheltered annuity plan or TSA is a retirement plan offered by public schools and certain charities.

These plans tend to be offered by public schools and some nonprofits. According to the IRS a 403b plan or tax-sheltered annuity TSA differs from a 401k in that it can only be offered by public schools and certain tax-exempt organizations. A 403b plan is also another name for a tax-sheltered annuity plan and the features of a 403b plan are comparable to those found in a 401k plan.

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity

403b Vs 401k Two Ways To Save For Retirement Stash Learn

The 401k Vs 403b Plan Find The Legal Difference Between Cc

Should I Rollover My Ira Or 401 K Into An Annuity

:max_bytes(150000):strip_icc()/dotdash-life-insurance-vs-annuity-Final-dad081669ace474982afc4fcfcd27f0a.jpg)

Life Insurance Vs Annuity What S The Difference

Annuities Prosperity Financial Group San Ramon Ca

Cno Financial Group On Twitter Do You Know The Difference Between An Annuity An Ira And A 401k During Annuity Awareness Month Learn How To Distinguish Between Each Of These Retirement Tools

Supersavers And The Roth Vs Tax Deferred 401 K Dilemma White Coat Investor

Annuity Vs 401k Which Retirement Plan To Choose

Should I Buy An Annuity From My 401 K 2022

Difference Between 401k And 403b Difference Between

403b Vs 401k Plans What S Better For Retirement Walletgenius

403 B Vs 401 K What S The Difference

![]()

403 B Vs 401 K Which Plan Retirement Plan Is Better

What Is A 403 B Retirement Plan Contributions Withdrawals Taxes

403b Retirement Plans Fisher 401 K

Tax Sheltered Annuity Definition How Tsa 403 B Plan Works

What S The Difference Between 401 K And 403 B Retirement Plans